Increased hiring in industrial warehouses, challenges the US job market

26 June, 2020

Last mile deliveries are reconfigured because of the pandemic

26 June, 2020

Nearshoring: the rise of Mexico

Competitive labor costs, the T-MEC and the persistent effects of a possible trade war between the United States and China have led to Mexico gaining participation in imports, making nearshoring the most prominent option to earn investments.

Mexico’s continued growth depends on investments for the long-term relocation of production capacity.

On the other hand, in the last two years, the United States and China have generated a trade war that has shaken American producers, forcing them to evaluate and remodel their supply networks, opening the way for Mexico to gain a more prominent place among the countries that they export manufactured goods to the United States.

According to Kearney’s seventh annual reshoring report, in 2019, over the past seven years, the Near-to-far (NTFR) index has ranged from 36% to 38%, that is, for every dollar of imports Of US manufactures from Asia’s Low Cost Countries, there are approximately 37 cents of imports of manufactures from Mexico.

This index analyzes the change in imports from the United States to Low Cost Countries, also known as LCC (China, Vietnam, Philippines, Malaysia, Indonesia, Pakistan, Sri Lanka, Taiwan, Thailand, Bangladesh, India, Singapore, Hong Kong and Cambodia) and the nearshore in Mexico.

However, in 2019, a change was generated towards Mexico, from 38% in 2018 to 42% in 2019. In terms of dollar value, total imports of manufactured goods from Mexico to the United States increased by 10% between 2017 and 2018 , from $ 278 billion to $ 307 billion, and another 4% between 2018 and 2019, up to a total import value of $ 320 billion.

The trade war between the United States and China, as well as the renegotiation of the T-MEC have accelerated the flow of production to Mexico. In addition, the imposition of tariffs on China of Section 301, the importation of goods of SCIAN (North American Industrial Classification System) Classification 33 from Mexico, which are the majority of its exports to the United States, increased by a 11% from 2017 to 2018, which represents the largest increase in just one year since 2011.

And as Section 301 tariffs were further increased in 2019, corresponding imports from Mexico increased by 4%, representing $ 11 billion.

When analyzed in combination with a sharp decline in tariff-related imports from China, the numbers strongly suggest that some U.S. manufacturers have used Mexico as a substitute for manufactured imports.

Compared to Asian countries, Mexico’s competitiveness of labor costs continues to improve. For example, the real salary CAGR (Compound Annual Growth Rate) in the last four years for manufacturing jobs in China was 7%, while in Mexico it was only 5%.

In addition, Mexico has a production base comparable to that of China, at least in certain aspects, which allows companies to have nearshoring capacity without the need to make massive investments in the recycling of labor or in the construction of new infrastructures.

Components can be obtained from the United States, assembled in Mexico, and shipped back to the United States in a short period of time. Even when adding the cost of import and export logistics, labor arbitration in Mexico can save producers between 20 and 30% compared to their cost of production in the United States.

Similarly, Mexico is benefiting from pressure from U.S. retailers to shorten supply chain deadlines, which pressure their suppliers to meet OTIF targets on time and in full, and impose economic sanctions. for deviations from its commitments to the OTIF.

Made in Mexico “could help manufacturers meet OTIF requirements with less working capital; it takes 75% less time to transport goods to the customer from Mexico compared to Asia.

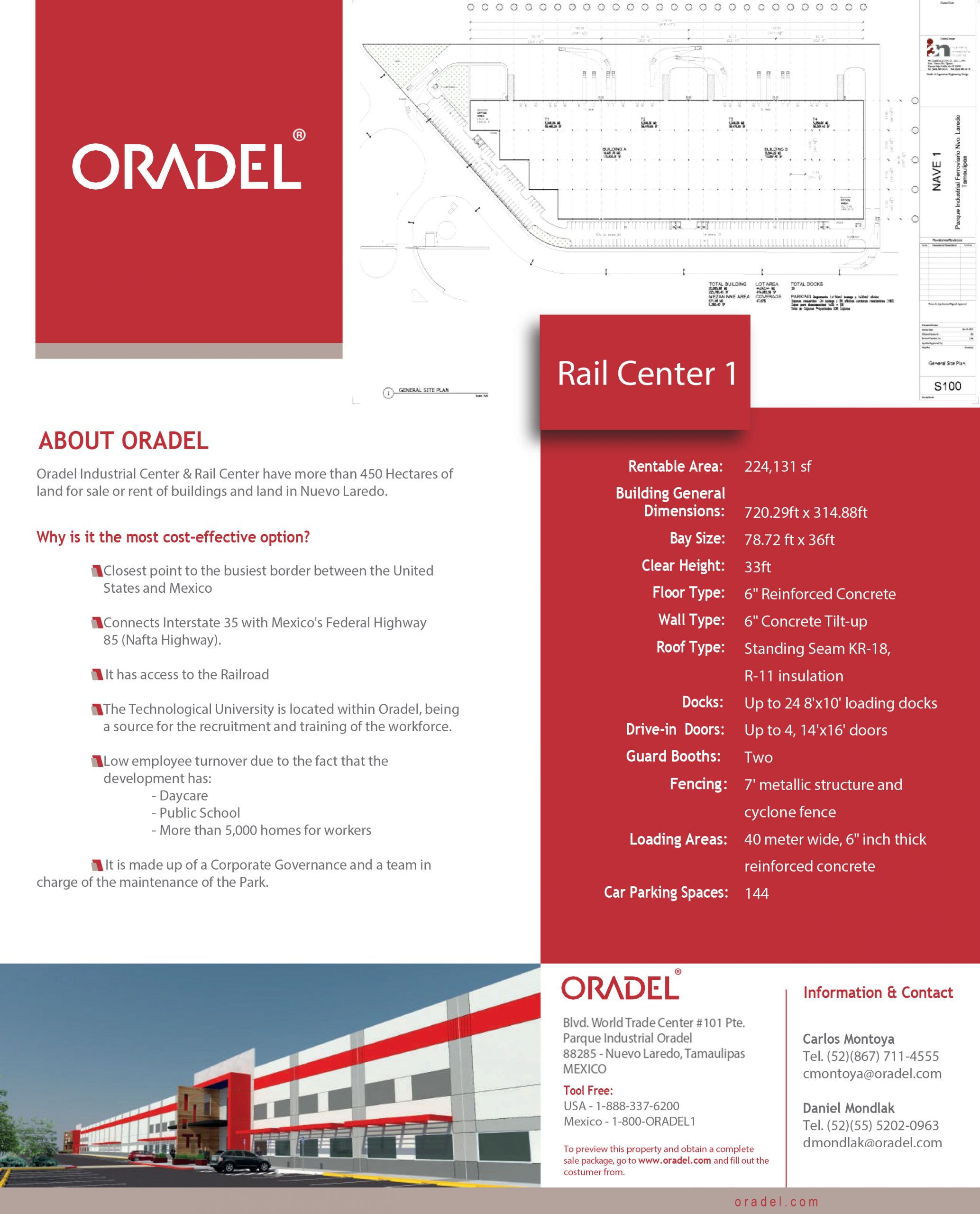

Oradel y su papel en el nearshoring en México

Oradel Industrial Center is a reference for the growth of nearshoring in Mexico, since its location means that exports to the United States are carried out in an efficient way.

In addition, the industrial park located in Nuevo Laredo represents a viable option for international companies seeking to establish their operations in Mexico, just 10 minutes from international bridges with the United States.