New perspectives on the future of the automotive industry

Mexico envisions opportunities with the FTA EU-MX

17 December, 2020

Industrial parks require advanced technology for better efficiency

18 December, 2020

New perspectives on the future of the automotive industry

After the pandemic, the main risks facing the Mexican automotive industry will be the result of the high dependence of the United States for vehicle exports, lack of qualified labor, lower sales in the domestic market and political uncertainty.

According to Francisco Bautista, Managing Partner of the Advanced Manufacturing and Mobility Sector of EY Latin America, the dependence on automotive exports to the United States is a risk for Mexico, since the chain is highly connected to that market, so if sales do not increase after the pandemic, the sector will be affected.

Mexico represents 18% of the automotive production in the Americas, with the United States being its main trading partner in exports (with 82.7%) and imports (with 34%).

This forms part of an uncertain domestic outlook, for example, from January to September 2020, 664,194 new light vehicles were sold in Mexico, which represents a 30.5% decrease compared to the same period last year. In September 2020, there was a 22.79% decrease compared to the same month in 2019, and by the end of this year it is estimated that sales of these vehicles will decrease by 28.3%, which represents 945,058 units. Moreover, in the aggregate from January to September 2020, light luxury vehicles had a 32.13% decrease in sales as compared to the same period in 2019.

Therefore, EY estimates that auto sales in Mexico will have an L-shaped recovery and it will not be until 2024 that the same levels of vehicle sales will be recorded as in 2019.

The USMCA provides legal certainty to companies. However, it brings new challenges to the automotive industry due to the added complexity of complying with regional and labor content value rules. Such restrictions imply a higher cost for companies.

Currently, vehicle manufacturers are in a transformation process due to changes in consumer preferences, new mobility offers, technology and restrictions on free trade. As a result, it is estimated that there will no longer be any investment in Mexico for installing new plants, since there is sufficient installed production capacity. Therefore, future investments will be for producing new models or technologies such as electric cars but without increasing manufacturing capacity.

Likewise, Bautista pointed out that the automotive industry has been facing the challenge of attracting talent for several years, so they are constantly seeking initiatives with universities and government in order to boost the growth of the workforce, as well as the learning of new technologies and skills. In addition, this sector generates 4 million jobs in Mexico and is one of the main drivers of exports, so it is important for the Mexican economy.

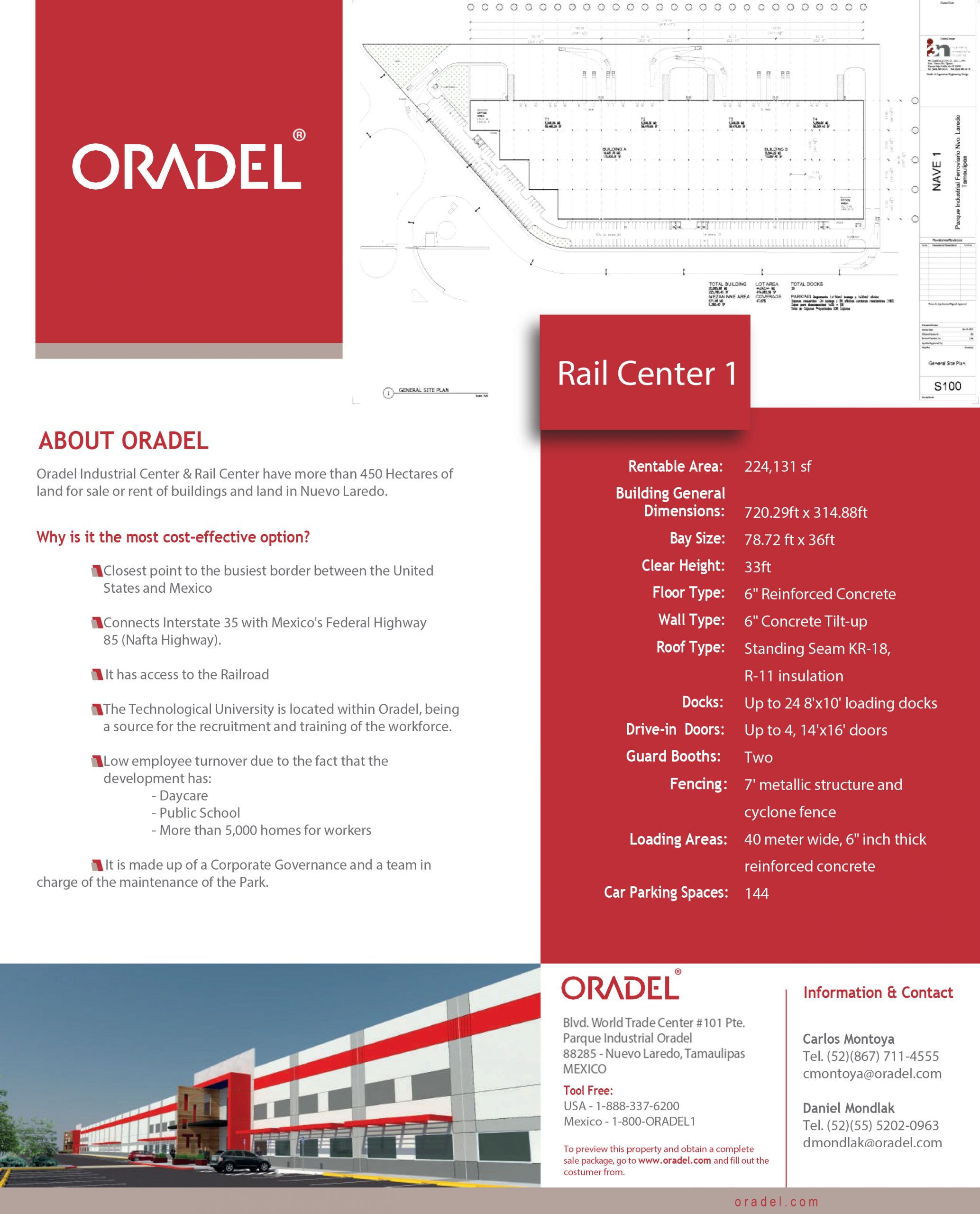

Oradel Industrial Center offers industrial space to international companies that wish to establish operations in Mexico.