Regulatory and commercial environment in the maquiladora industry

Logistics plays an important role in the recovery of the industrial sector

3 September, 2020

Industry 4.0, lever to speed up the resilient supply chain

3 September, 2020

Regulatory and commercial environment in the maquiladora industry

With the signing of the United States-Mexico-Canada Agreement (USMCA), a new era in the regulatory environment of the maquiladora industry has formally begun.

According to Luis Ricardo Rodríguez Meneses, CEO of the Global Strategy Consulting firm, Mannat Jones, with regard to the externalities in trade, the North American Free Trade Agreement (NAFTA) came into effect in the midst of an economic crisis that began in December 1994, which caused the devaluation of the Mexican peso, but underpinned the competitiveness of the export manufacturing sector.

After 26 years, the USMCA aims to extend the undeniable commercial success of the previous treaty.

Now, however, with the COVID-19 pandemic, just as in 1994, the fall in oil prices and the gloomy global outlook make it impossible to immediately quantify the economic benefits of the USMCA.

Moreover, this new treaty will not have a major impact on the preferential tariff treatments, as these barriers have been virtually non-existent for several years.

Therefore, the success of the USMCA will depend on the region’s ability to address trade differences and complement each other in a supply chain by leveraging the respective strengths of the three countries.

Opportunities and risks for the maquiladora export industry

As far as the maquiladora export industry is concerned, there are two factors that represent opportunities.

-The recent devaluation of the Mexican peso against the dollar, which ranges between 20% and 25%, although some analysts project that it could be extended at the end of this year and that it presents an adequate scenario for international investments as well as for national export companies.

-The instability of trade relations between the United States and China, encouraging the relocation of manufacturing operations to Mexico.

However, there are also some risks in this new commercial regulatory environment, since it will be of great importance for manufacturing companies, mainly automotive suppliers, to adapt their processes and content to comply with the new rules of origin, including those related to the value of regional content.

Similarly, it will be important to monitor the outcome of the National Association of Free Trade Zones (NAFTZ) negotiations regarding the possibility that Free Trade Zones (FTZs) in the United States may apply the principle of a reverse tariff for non-originating inputs, which was prohibited in NAFTA.

This would give an advantage to the FTZs that is currently not foreseen for companies in the maquiladora industry in Mexico and would justify the implementation of assembly and manufacturing processes.

Without a doubt, a key element for the success of the North American trade agreement will be the regulatory environment and any confidence that the Mexican government can provide to the export sector, as well as the level of certainty Mexico can assure with respect to its tax and operational treatment.

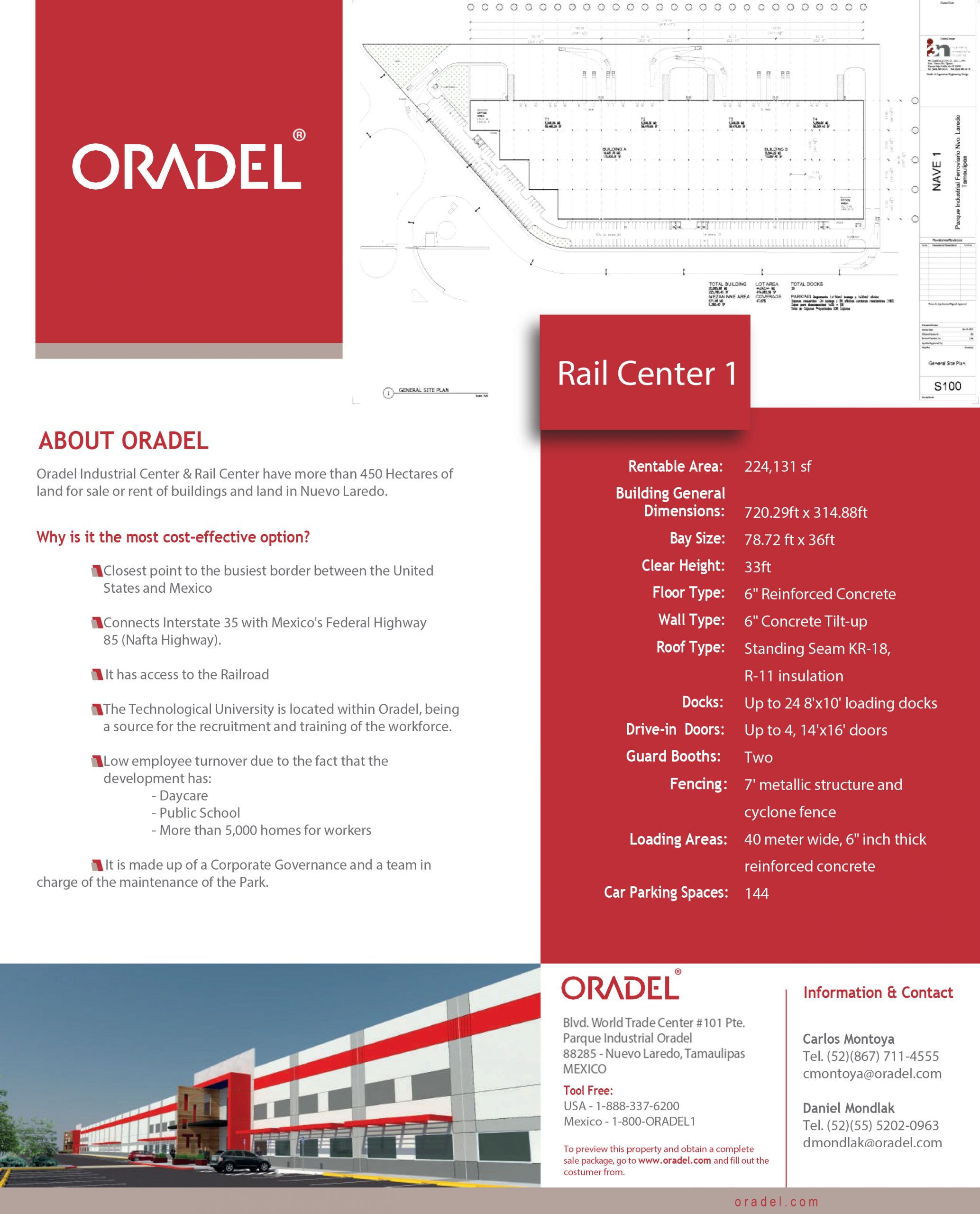

Oradel Industrial Center has the best NE location in Mexico for international companies interested in establishing their operations in Mexico. It offers all the advantages and opportunities of the USMCA and it provides a wide range of tilt top industrial buildings with all services (water, electricity, etc.) for immediate occupancy.