USMCA: Strengthening the automotive industry

USMCA is an historic opportunity for the Mexican economy

3 August, 2020

USMCA: Increased competitiveness in Mexican industries

4 August, 2020

USMCA: Strengthening the automotive industry

The entry into force of the USMCA brings important challenges for the Mexican automotive industry due to the new regulations, but it also brings opportunities for the border states.

The states that are geographically located on the border with the United States have the opportunity to develop domestic supply, and attract new auto parts companies that will establish themselves in Mexico to comply with the new rule of origin percentage set out in the agreement.

One of the most important changes in the USMCA to impact the country’s automotive industry is the increase of the national content in automotive manufacturing, known as the rule of origin, from 62.5% to 75%.

The new opportunities and challenges of the USMCA

The challenges that most concern auto manufacturers in Mexico, according to experts, are the rule of origin percentage and labor content percentage, coupled with the approval of a 16 dollar an hour salary standard across the three signatory countries (Mexico, United States and Canada).

According to Cesar Buenrostro, leading partner of International Trade and Customs at KPMG in Mexico, compliance with the rule of origin will occur gradually, reaching 66% this year and increasing 3% each year after that, until reaching 75% in 2023.

In addition, the agreement sets out that the labor content shall increase from 30% to 40% in 2020, that is to say, this 40% represents that the value of the vehicle should be produced in a country that pays its labor force 16 dollars an hour.

One of the main advantages of the USMCA is that it gives legal certainty to investors for a period of up to 32 years.

According to Manuel Nieblas Rodríguez, a leading partner of Deloitte’s Manufacturing Industry, meeting the 70% steel content from the region within seven years for light vehicles is another challenge for assembly plants, as the steel and aluminum used in this industry currently comes from Japan and South Korea, countries specialized in high quality steels. Therefore, local suppliers will have to be developed to be able to produce these materials.

Effects of the pandemic on the automotive industry

Mario Hernández, a leading partner of the Manufacturing, Maquiladora and Export Services Industry (IMMEX) at KPMG, believes that the fall in demand for products worldwide as a result of the pandemic will be troubling, and vehicle sales are not exempt from this fall. According to the Mexican Association of Automobile Dealers (AMDA), light vehicle sales in May 2020 fell 59% compared to May 2019.

Furthermore, HSBC Global Research in the Snapshot of the Auto Sector report, which addresses the impact of COVID-19 in the automotive sector in Mexico as well as the industry’s performance in gradual economic recovery, indicates that the USMCA will have a positive effect as it will provide trading certainty; however, domestic sales are expected to increase more slowly.

According to the report, during April, Mexico’s automotive production registered a record fall of 99%, while domestic sales and exports had a decrease of 65% and 90%, respectively.

Another relevant factor is that, due to its strong production and trading relationship with the United States, the automotive manufacturing industry has a fast-track to normalization.

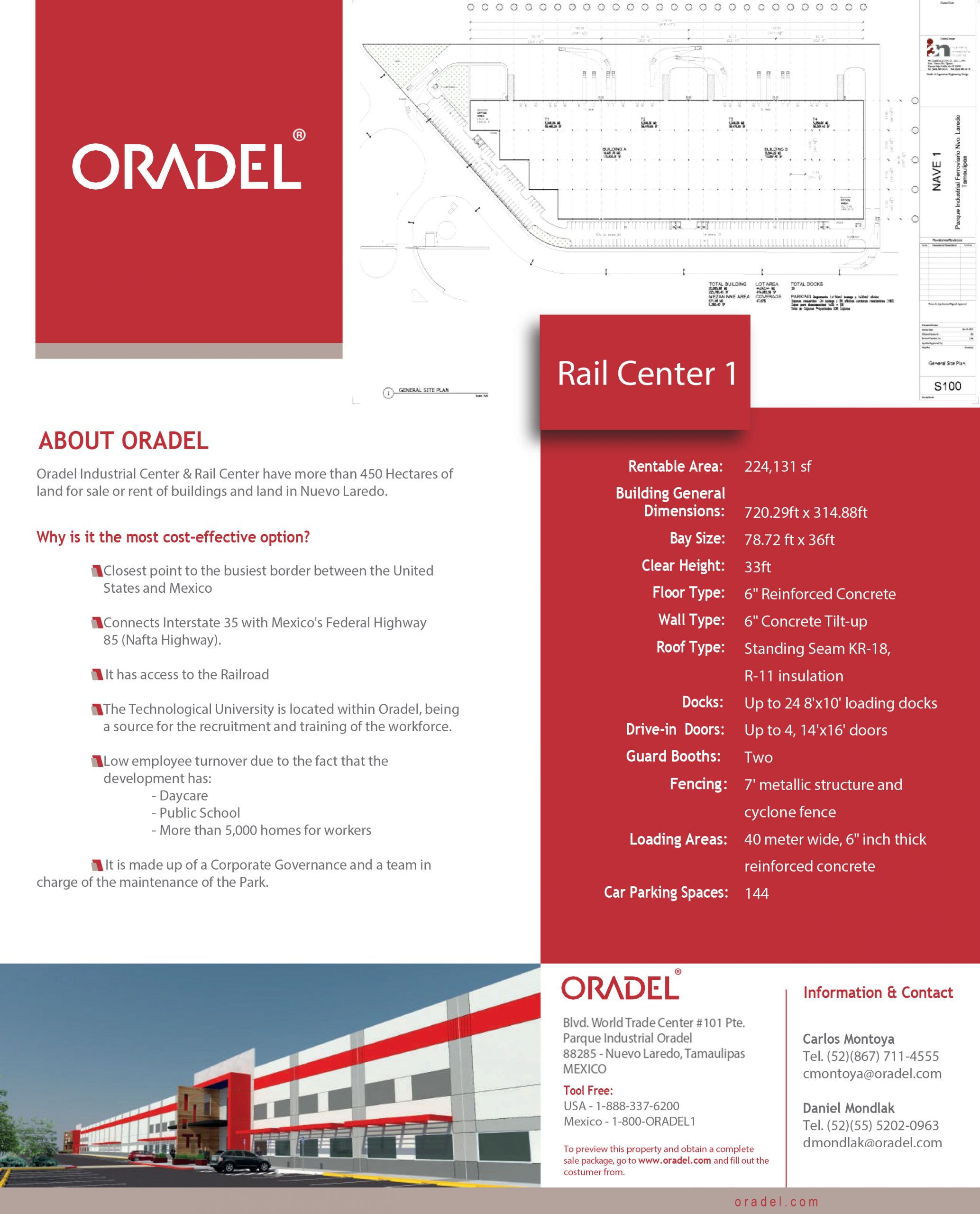

Oradel Industrial Center knows the automotive sector’s needs, and believes that manufacturers in this sector have the advantage of renting or buying industrial buildings right next to the border with the United States and benefiting from the USMCA.