With the USMCA, Mexico has the opportunity to gain market share over China

Manufacturing activity in the world’s major economies bounces back

3 September, 2020

Logistics plays an important role in the recovery of the industrial sector

3 September, 2020

With the USMCA, Mexico has the opportunity to gain market share over China

Last year, China lost 5 points in the U.S. market, and tensions between China and the U.S. will cause some companies to look at the possibility of stopping production in the Asian country and looking towards Mexico, which has the advantage of the USMCA, said Carlos Serrano, chief economist with BBVA in Mexico.

The trade agreement between Mexico, Canada and the United States (USMCA) is a great opportunity for Mexico to recover its competitive position ang a market share in the U.S. economy from China, a country that has long waged an undeclared trade war with the United States.

For a bit of context, one third of U.S. exports are components produced in different parts of the world, including imported cotton, engines and assembly machinery for complex industries. This allows both U.S. producers and consumers to expect lower prices for intermediate or finished products thanks to international trade.

The impact of the pandemic on global supply chains

Another fact that benefits Mexico is that the Covid-19 outbreak has made the dependence on and concentration of Chinese manufacturing clear, and companies will seek to diversify operations.

Undoubtedly, the spread of the coronavirus has disrupted supply chains worldwide in every sector, from the automotive industry, to cell phone producers, energy companies, pharmaceutical and chemical products companies; as well as people, economies, and the security of countries. Seeing the Chinese manufacturing sector immobilized made the vulnerability of international supply chains clear.

In this context, Mexico has advantages that could help it assume a leading role and capitalize on this situation in order to attract new investments, since transnational companies have begun to consider the risks of having a large part of the world’s manufacturing clusters in the country where the coronavirus originated.

According to EY, a business advisory , consulting, auditing and financial services firm, the shutdown of Asian plants reduced the manufacturing and supply capacity of countries, which, coupled with the approval of the USMCA, has motivated companies around the world to accelerate changes in their supply chains to depend less on China, again making Mexico an attractive place to invest, provided the United States and Canada continue to coordinate closely with Mexico as regards production chains.

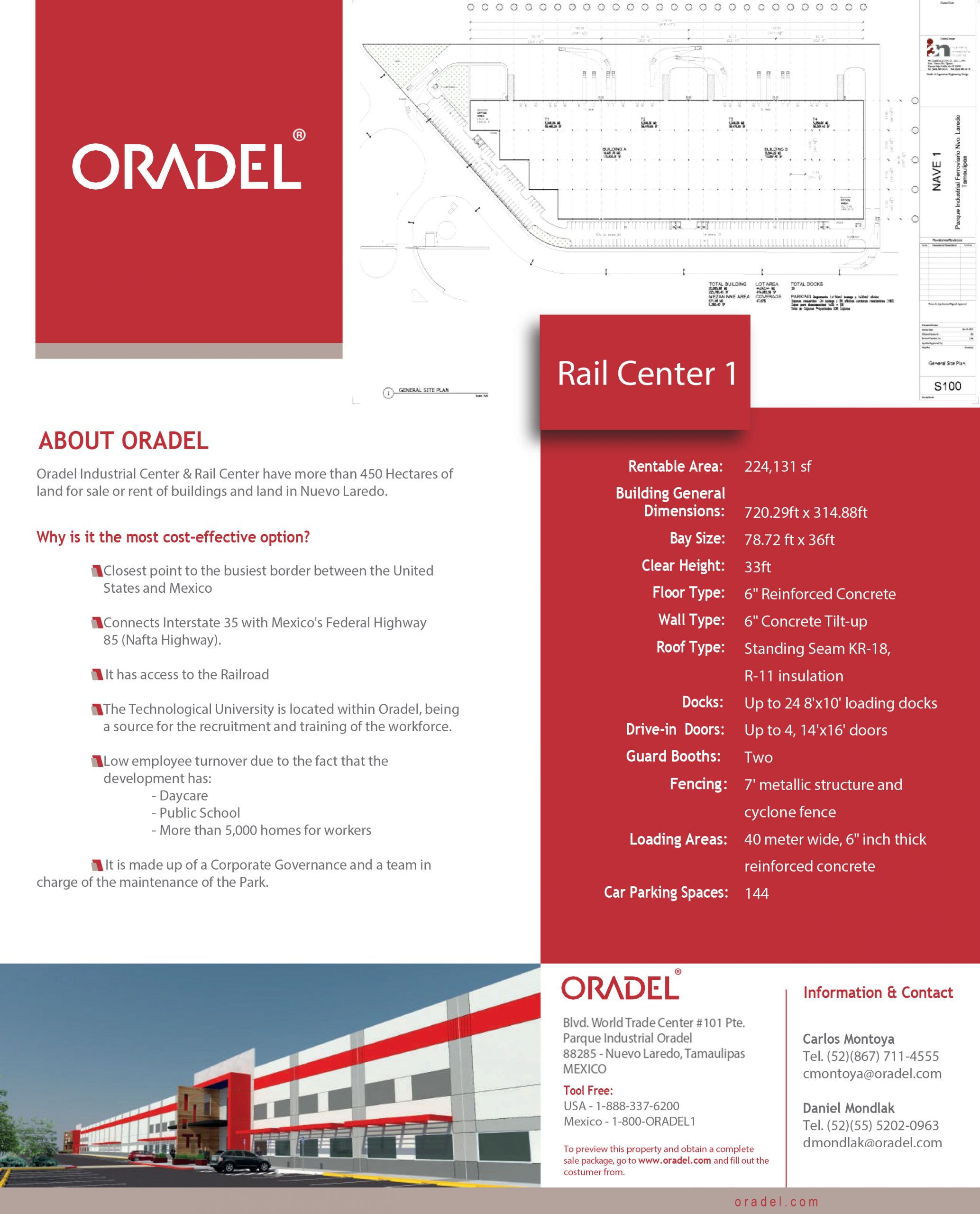

Oradel Industrial Center is an option with competitive advantages for international companies looking to establish their operations in Mexico. The industrial park is only 10 miles from the International bridges, facilitating foreign trade.