Costs will drop for manufacturing companies that move their operations from China to Mexico

USMCA triggers opportunity for manufacturing production in ports and industrial parks

5 October, 2020

The GDP of developed economies will decrease by up to 5 % over the next 10 years

5 October, 2020

Costs will drop for manufacturing companies that move their operations from China to Mexico

The current global situation will force U.S. manufacturing companies to expand their horizons and move their production outside of China to another low-cost nation. The consulting firm PwC estimates that operating costs could drop by 24% for companies moving to Mexico.

According to the consulting firm’s report, the COVID-19 pandemic changed U.S. manufacturing companies’ perspective on the location of their productive units. The key reason for dependence on China is due to its advantages regarding cost and scale; however, the COVID-19 is forcing companies to expand their horizons and consider other locations, such as Mexico.

From the report titled “Beyond China: Towards greater diversification and cost efficiency in supply chains,” Pwc analyzed attractive options for global supply chains, considering issues such as destination cost, delivery times and risk factor.

In addition, 80% of imports manufactured in China could be cost efficient if they were produced in other low-cost Asian countries, such as Malaysia, Vietnam or Thailand.

According to Carlos Zegarra, Management Consulting Partner at PwC Mexico, although it is still early to expect the complete change of supply chain locations, the current crisis and the search for alternative sourcing are forcing the implementation of mixed-model chains in order to relocate different production processes nodes.

In addition, Zegarra said that manufacturing companies will have to seek the right balance between resilience levels and operation costs. Mexico is a good option in this respect, and will contribute to further developing this sector and the economic growth of the country.

USMCA as a competitive advantage

PwC’s report highlights the entry into force of the USMCA as one of the main advantages offered by Mexico, providing greater stability to trade relations among the three countries that make up this trade agreement.

In addition, the cost of Mexican labor remains competitive with other developing countries as prices in China are on the rise, and low logistical costs and the consolidation of the maquiladora industry promote competitive manufacturing and drive the creation of employment.

Similarly, Mexico could be an option in a dual-supply chain scenario. For example, China and Mexico, or other low-cost countries in Asia, could generate savings of 5% to 20% compared to continued sourcing from China alone.

Keeping these factors in mind, manufacturing companies in general, and U.S. companies in particular, should assess their supply chains to see if they need to readjust their global presence.

Today, Mexico can provide greater diversification and cost efficiency to mitigate the commercial and geopolitical disruptions that U.S. companies have had to endure in recent years.

According to a survey with PwC’s finance executives called “CFO Pulse,” 25% to 30% of CFOs in the U.S. and Mexico, respectively, agree that developing alternative sourcing options as well as changing the contractual terms of supply chains are essential to rebuilding and improving their sources of income.

Furthermore, according to the supply chain survey, 16% of U.S. companies operating in China already had plans to change their production or supply sources prior to the pandemic.

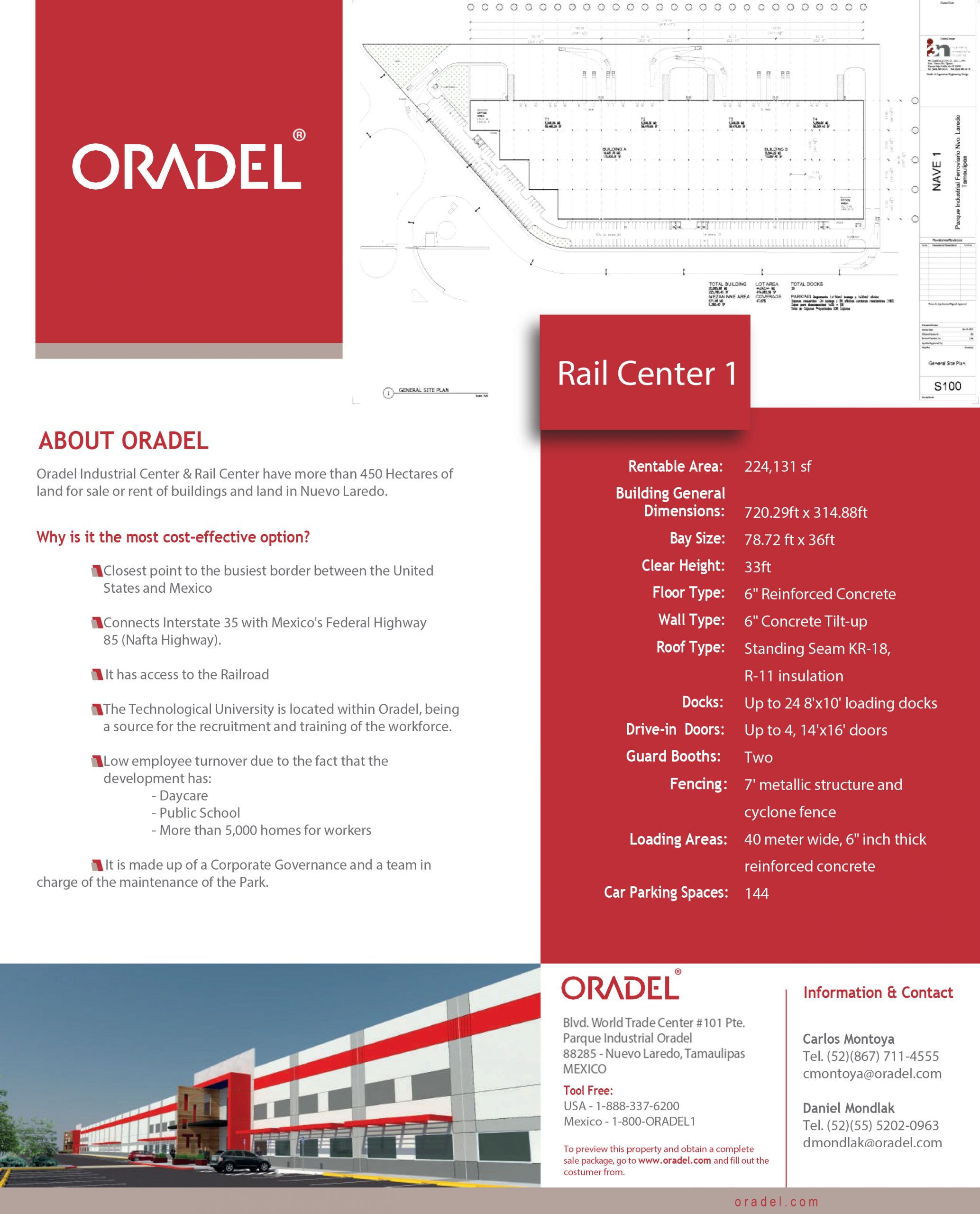

Oradel Industrial Center has the necessary infrastructure for construction of industrial buildings tailored to the needs of international companies seeking to establish their manufacturing and logistics operations at the Mexico US border.