The economic consequences of disrupting global supply chains

Strategy to innovate manufacturing companies

3 August, 2020

The industrial real estate sector is expected to recover in the short term

3 August, 2020

The economic consequences of disrupting global supply chains

The disruption of supply chains generated by the effects of the COVID-19 pandemic is a unique event that is generating a global recession.

According to Dalia Marin, Professor of International Economics at the Technical University of Munich and a member of the research team of the Center for Economic Policy Research, global supply chains were the driving force of economic globalization for almost thirty years. From 1990 to 2008 they caused trade to expand and accounted for 60-70% of its growth. However, twelve years later, they’ve stagnated.

Currently, the COVID-19 pandemic has led to a recession with a downturn in supply, and uncertainty may slow the expansion of global value chains by at least 35%. If the situation continues, companies could relocate their operations from Asia to other parts of the world, as world trade is no longer expanding at the same rate as the world Gross Domestic Product (GDP).

A reduction in production in companies worldwide will, without a doubt, create a recession unlike any seen before. According to the IMF, the OECD, and other international organizations, the next year will show a V-shaped recovery, which implies a short period of stabilization and a rapid recovery in the economic growth rate. However, given the severity of supply chain disruption in the current crisis, this recession is considered unique.

Anticipating a recovery requires understanding the effects of the recession on global supply chains. A broken link can disrupt the entire production network in a sector, and such disruptions can spread throughout the economy depending on the sector’s importance as an input supplier for other sectors.

It should not be forgotten that companies are vulnerable in various ways. For example, suppliers who were affected by the quarantine hand production losses down to their clients when the input they produce is client-specific, and thus involves a high level of research and development. That’s why, in these cases, the decision to change suppliers becomes a costly and time-consuming process. However, in reality, pandemic-related disruptions are considered unique.

After investigating three decades of major natural disasters in the United States, Jean-Noël Barrot and Julien Sauvagnat from MIT discovered that company sales growth dropped by 2-3% for suppliers who were affected by a flood, earthquake, or similar situation.

In these circumstances, Dalia Marin considers that the only option is to encourage the growth of specific sectors through stimulus programs. However, new macro models of the pandemic suggest that a specific sector may cause the greatest fiscal boost per dollar invested, but a pandemic where 50% of the economy is totally closed down does not compare to an economy where all activity collapses by 50%, like in a depression.

Therefore, the best way to maximize the impact of a fiscal stimulus is to identify industries that cannot be substituted. For example, in Germany, like in other parts of the world, the automotive sector is irreplaceable, as it has a complementary relationship with the rest of the economy. The more cars bought, the greater the demand for auto parts, and this industry imports only 29% of its inputs, compared to 76% in textiles.

A positive impact on the global economy can be generated by identifying and boosting irreplaceable industries worldwide, such as food, soft drinks, or the medical industry.

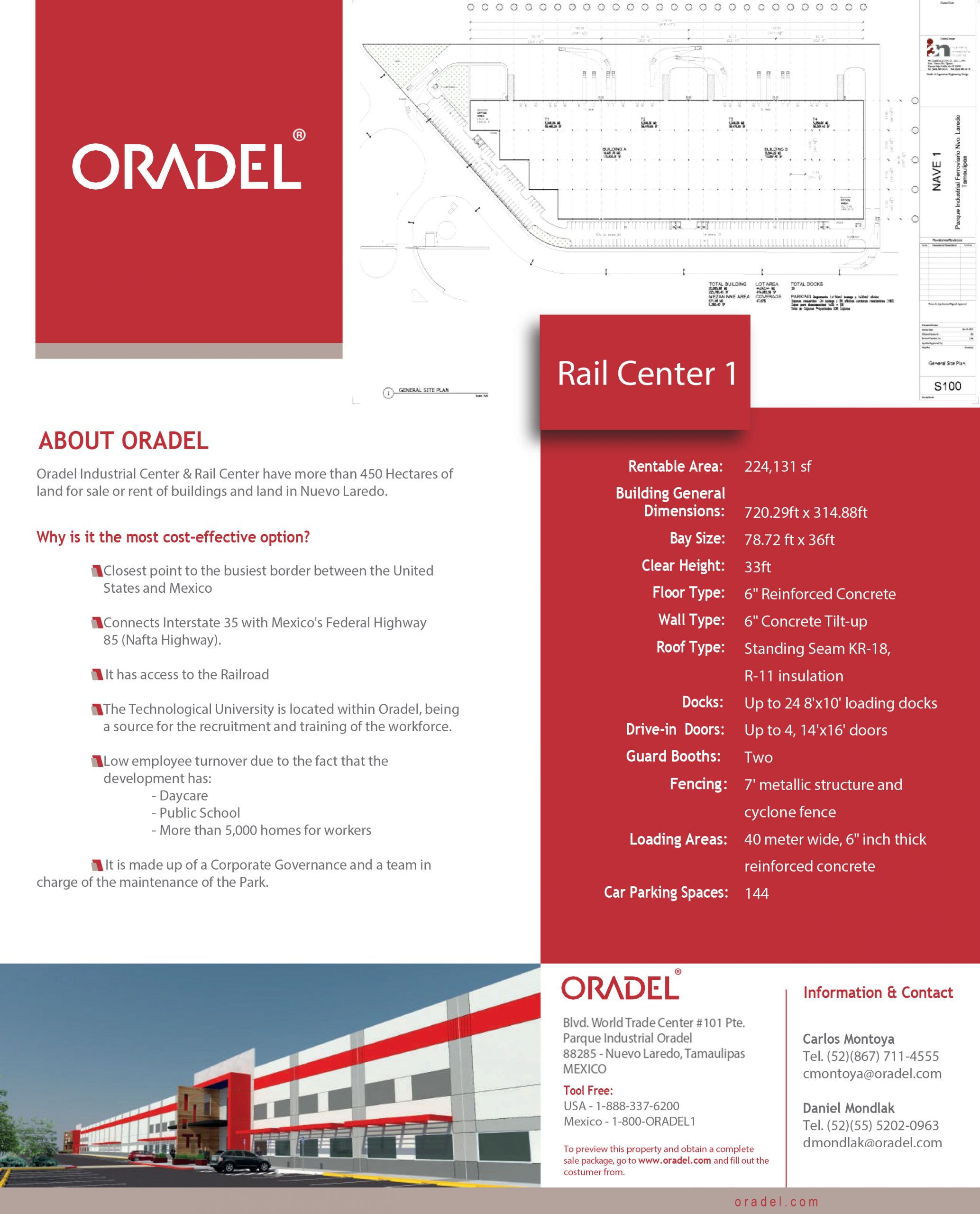

Oradel Industrial Center seeks to offer industrial space for international companies to establish their manufacturing operations in Mexico in a strategic location, very close to international border crossings.