China dominates investment intentions in Mexico

5G technology key to Mexico’s digital transformation and economic recovery

5 October, 2020

G-20 highlights the contribution of trade in services to Mexico’s manufacturing exports

11 November, 2020

China dominates investment intentions in Mexico

Despite the fact that most projects are on hold due to the effects of the COVID-19 on the economy, almost four out of every ten investment initiatives that industrial parks in Mexico have received come from China, a trend predominantly marked by the nearshoring or relocation of production to countries near major consumption centers.

According to an internal survey by the Mexican Association of Industrial Parks (AMPIP) this year, China has accounted for 37% of new initiatives and projects, while the United States, considered the main historical source of foreign investment in the country, contributed 16%, followed by Japan and Mexico itself with 12% each, South Korea with 9% and Germany with 5%.

This survey was given to 34 industrial developers that are AMPIP members and have a presence in the Central, Western, Bajío and Northern areas of the country.

38% percent of the companies located in industrial parks are from Mexico, while the remaining 62% are mostly from the United States (31%), Japan (6%), Germany (6%), South Korea (3%), Canada (3%), France (2%), Spain (2%) and China (1%).

Currently, there is an incentive to have imports from somewhere other than China. Companies with investments in China, regardless of the source of the capital, are conducting cost analyses to determine whether it is more profitable or less risky to move their production near the target market.

When the consumer market is the United States, Mexico is clearly the most attractive destination for relocating their investments, but these types of changes must make economic sense for companies.

The survey conducted by AMPIP showed that logistics, distribution and storage have been the most active sectors with 25%, having a greater contribution of capital from Mexico and driven by the changes caused by the COVID-19 pandemic; followed by the automotive segment and related industries with 14%, the electronics sector with 10%, medical devices with 8%, e-commerce with 6%, Industry 4.0, processed food and clothing with 5%, respectively.

Furthermore, 18% of those surveyed believe that companies will restart their investments in the last quarter of 2020, 15% say they will do so in the first half of 2021 and 18% in the second half or even wait until 2022.

There are two specific factors that are creating investment opportunities in Mexico: the entry into force of the United States-Mexico-Canada Agreement (USMCA) on July 1 and the undeclared trade war between the United States and China that has been ongoing for the last two years.

The AMPIP states that Mexico has a strategic and privileged geographical position for the manufacturing industry so it is essential to promote the economic development of the country with an outlook of at least 50 years. For example, industrial parks are moving their marketing processes towards more digital structures to deal with the situation brought on by COVID-19.

Meanwhile, the Ministry of the Economy said that during the first half of the year the Mexican economy received an inflow of Foreign Direct investment of 17.96 billion dollars, 0.7% less than in the same period last year.

In addition, considering the type of investment and source of financing, the reinvestment of profits was 53.5%, new investments 16.9% and intercompany accounts 29.6%.

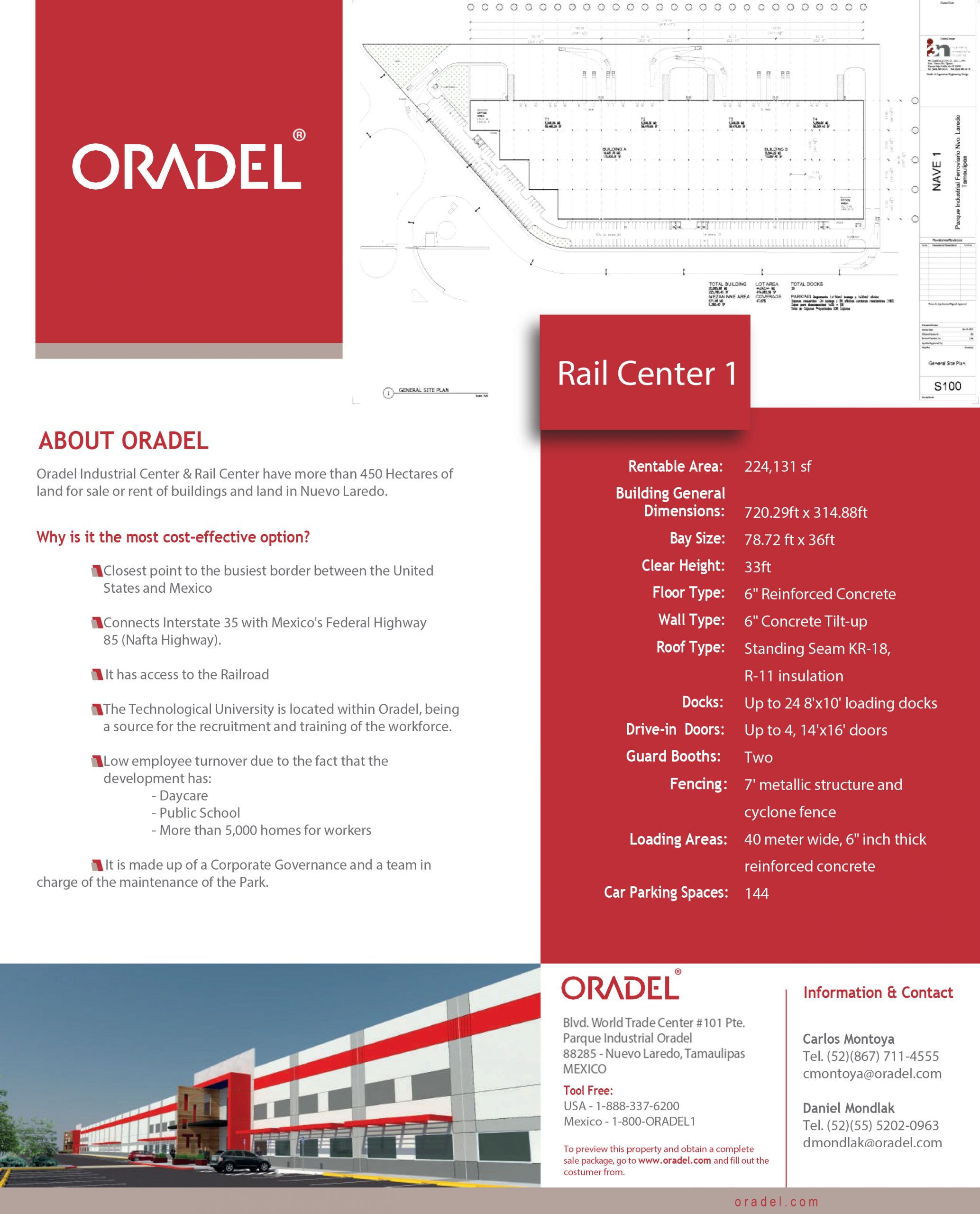

Oradel Industrial Center offers the best location for logistics and manufacturing companies in the Mexico US northeast border. It has industrial buildings, with or without rail service, ready for occupation as well as buildings built to suit the needs of the industries.