Investments in the Mexican automotive sector aren’t slowing down

Foreign Direct Investment, an opportunity and a challenge for Mexico

11 November, 2020

The economy might not recover until 2024

11 November, 2020

Investments in the Mexican automotive sector aren’t slowing down

Four automakers have invested more than 2 billion dollars in their plants in Mexico to begin producing new models that will be marketed in North America.

Currently, there is a global automotive production capacity of 95 million vehicles per year, however, the coronavirus pandemic has caused idle capacity in plants. That’s why, before considering the construction of new facilities, automakers are seeking to reactivate their existing ones.

Automakers are only investing in modernizing or expanding their current plants to be able to produce the new generations of their models, even though the new investments are usually less attractive than those created by building new plants. The investments recently implemented in Mexico add up to over 2 billion dollars, which is the equivalent to the construction of two assembly plants. For example, Ford, Nissan, Toyota and Volkswagen have invested in their facilities in Mexico in order to start producing new models, comprising of two SUVs, a sedan and a pickup, which will be sold in North America.

Following the entry into force of the United States-Mexico-Canada Agreement (USMCA) investors have regained confidence in the Mexican market, which in recent years has been positioned as a vehicle production and export platform that can supply more than 40 markets on four continents at competitive costs; the U.S. is most important market for automakers, as it is the second largest consumer of vehicles globally, after China.

In the midst of the pandemic, the United States has become a means of recovery for the automotive sector as the demand for vehicles, especially pickups and SUVs, is rapidly recovering.

According to Stephanie Brinley, Automotive Analyst at IHS Markit, the first half of the year mostly followed the general trends for 2019, even if the purchase of pickup trucks increased in market share, and in the second half, automakers will continue to adjust vehicle production by moving from subcompact vehicles to make room for new utility vehicles, such as SUVs and CUVs.

Automakers have resumed the planned investments for their plants in Mexico in order to start production of the new generations of pickups and SUVs.

Investments in the Mexican automotive sector

1.- Toyota: The automaker announced an additional investment of 170 million dollars to expand production of the Tacoma pickup at its plant in Guanajuato, opened in December 2019. After making the decision to stop producing this model in Texas, United States, it moved that production volume to the Mexican plant due to the success that the new generation of this pickup has had in the American market.

Currently the plant has the capacity to produce 100,000 units per year, and as of January 2022 it will assemble 138,000 Tacoma once all additional investment has been made, which has also created 500 new jobs.

In addition, according to data from the National Institute of Statistics and Geography (INEGI), from January to August of this year, Toyota assembled 80,798 Tacoma units and sent them to the United States.

2.- Ford: This year, Ford invested 1 billion dollars to modernize and expand its Hermosillo plant and start production of the Bronco Sport, an off-road SUV based on the Escape platform but with reinforced suspension.

To make room for that new production as well as the next generation of the Transit Connect van, Ford discontinued production of the Fusion and Lincoln MKZ compact sedans in July. From 2017, the automaker announced it would stop producing its sedan lineup (Taurus, Fusion and Focus) and focus on developing new SUVs, crossovers and pickups.

The Sport version will be one of the three models sold by Ford, and the other two will be produced in the United States, mounted on the Ranger pickup platform.

3.- Nissan: The Japanese automaker invested 244 million dollars this year to begin production of the eighth generation, and fifth generation marketed in Mexico, of its compact sedan, Sentra, in the Aguascalientes plant, which has exclusively assembled this model since it opened in 2013.

At the end of June, Nissan reported that 74% of the investment was for the development and production of the new generation of the engine, while the remaining 26% was for adjusting the production line for the production of this vehicle. The production of this new generation of the sedan will supply the local market, and will also be exported to 28 other markets.

4.- Volkswagen: The German automaker invested 600 million dollars to begin production of a new medium sized SUV at the Puebla plant, which will be sold as the Taos and will be positioned above the T-Cross, and below the long-wheelbase Tiguan, which is also produced at the same complex in Mexico.

The Taos will be mounted on the MQB, Modular Transverse Matrix, platform that the automaker has used to develop some thirty models for its Volkswagen, Audi, Seat and Skoda brands, creating an economy of scale.

According to Steffen Reiche, CEO of Volkswagen Mexico, this project will allow the Mexican plant to continue growing and support the country’s economic recovery.

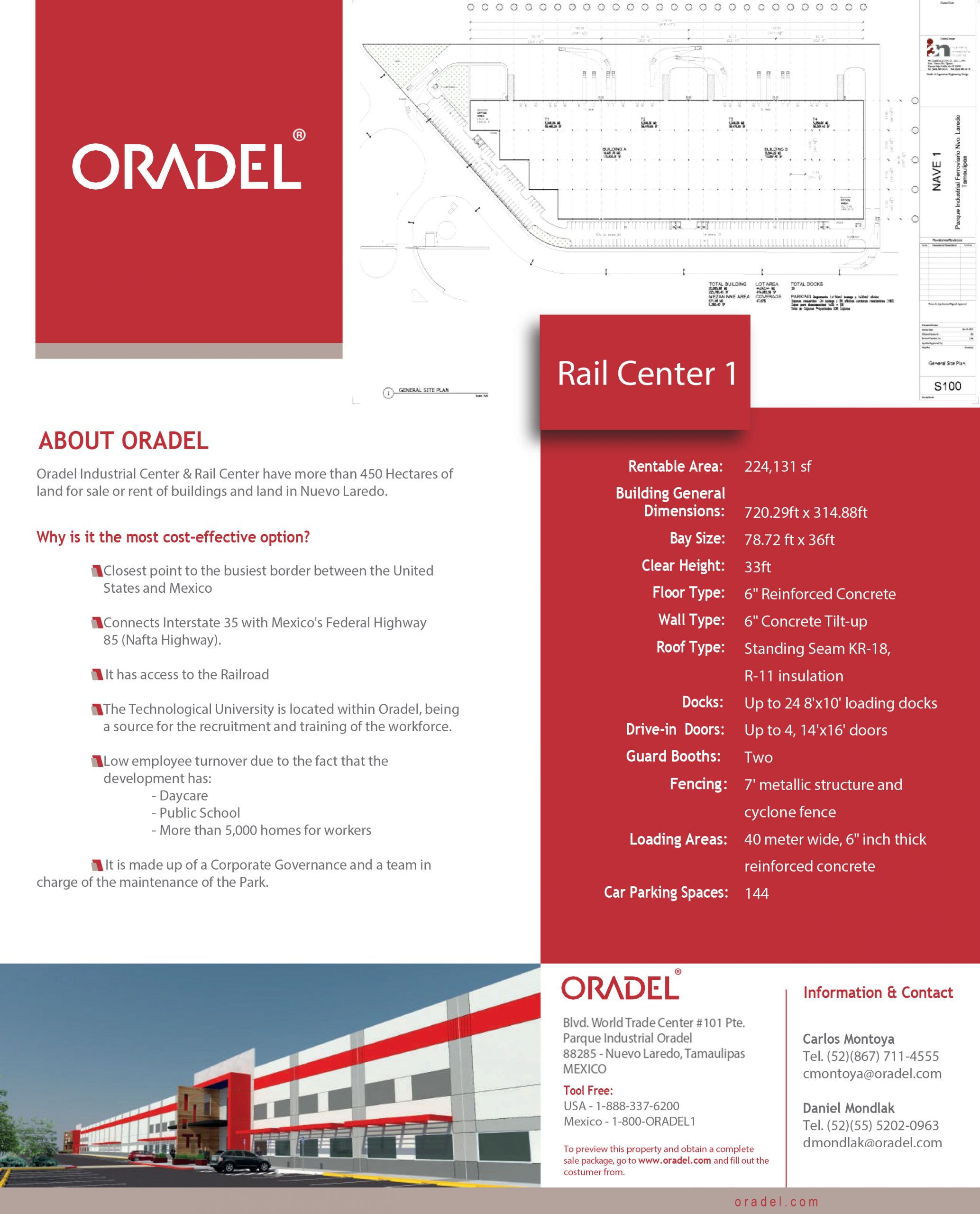

Oradel Industrial Center contributes to the growth of Mexico’s economy, offering the sale and rental of industrial buildings to companies from various industrial sectors that want to establish their manufacturing operations in Mexico.